Crypto in the Income Operating System: The Pyramid That Holds

There comes a point in every investing era where the consensus shifts. The late adopters finally admit the skeptics were wrong. The mainstream stops calling it a fad. The regulators, the banks, the institutional investors all move in at once. That is what we are living through with crypto. The years of people dismissing it as vaporware, as a scam, as a toy for speculators are over. Between COVID, inflation, and the continual debasement of fiat currencies, Bitcoin and its ecosystem have not only survived but cemented themselves as a legitimate asset class. They have held value in times of chaos, they have created fortunes for the bold, and most importantly, they are now fully embedded in Wall Street’s product pipeline. When BlackRock and Fidelity roll out ETFs, the signal is clear. This is not an experiment. It is financial infrastructure.

Inside the Income Operating System, we focus on three levers: employment, freelancing, and investing. Investing is the long-term play. It is the arena where you compound wealth over decades. And within that arena, you need clarity. The universe of investments is infinite. Stocks, bonds, ETFs, real estate, small businesses, and yes, crypto. The temptation is to scatter. To treat crypto like a lottery ticket or a Vegas weekend. That is not how serious investors approach it. The disciplined way to treat it is with structure. And that is where the crypto investing pyramid comes in.

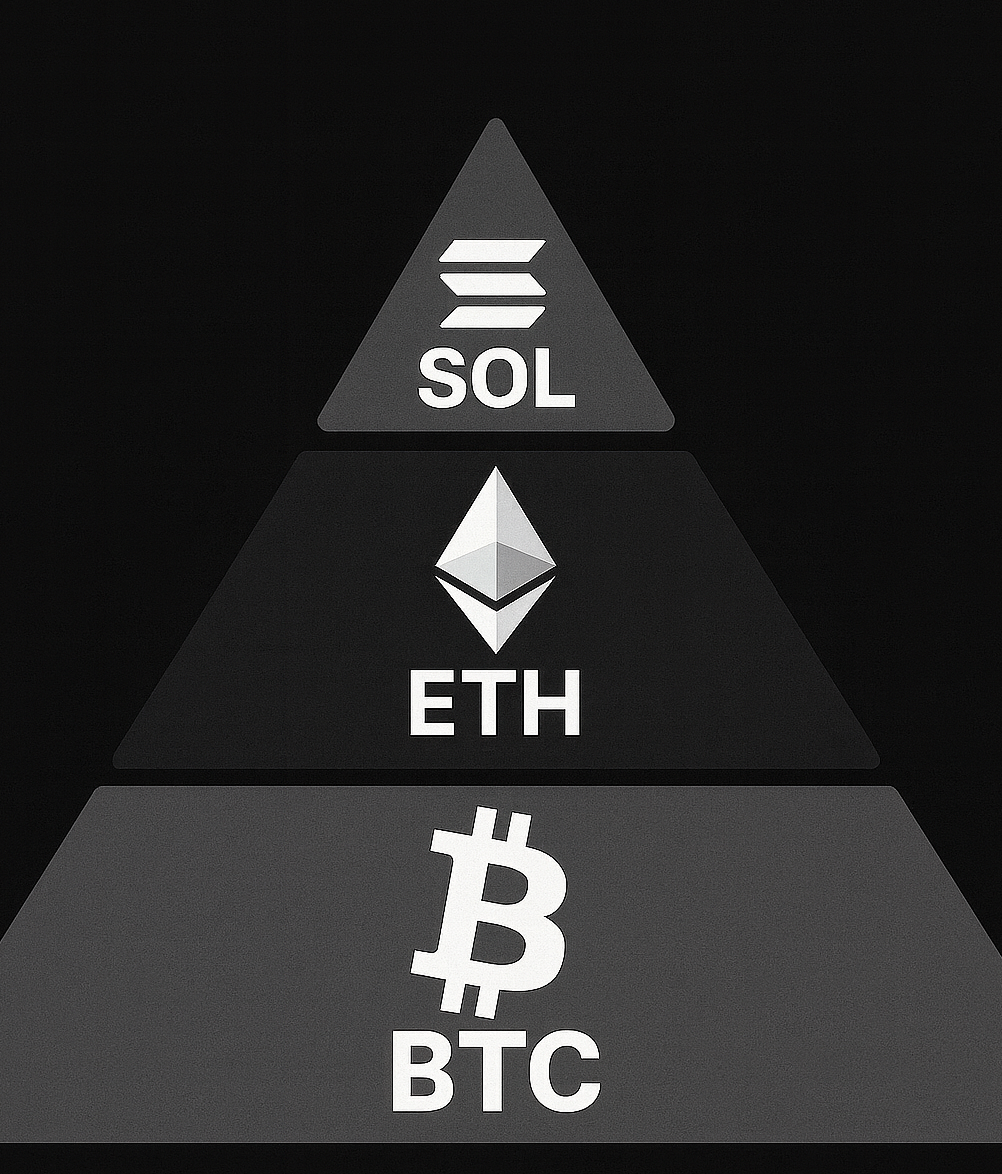

The base is Bitcoin. The middle is Ethereum. The tip is Solana. That is your framework. It is simple, elegant, and it matches both adoption curves and risk profiles. Think of it like the food pyramid of your portfolio. The foundation is built on the most proven, liquid, widely adopted crypto. The middle tier adds growth and yield. The tip adds speculation and potential asymmetric upside. You do not need to chase every altcoin, every meme token, every fleeting trend. Three assets give you exposure to the entire phenomenon.

Start with Bitcoin. It is digital gold. That phrase gets overused, but it is accurate. Gold was humanity’s store of value for thousands of years. It worked because it was scarce, it was hard to mine, and it was universally recognized. Bitcoin inherits all those properties, but adds portability and verifiability that gold never had. You can move a billion dollars across borders in minutes. You can verify ownership on a public ledger instantly. You can store it without vaults or armed guards. In a digital, global economy, Bitcoin is superior to gold. That is why central banks are quietly accumulating. That is why ETFs like IBIT exist, giving you direct exposure without worrying about wallets or custody. That is why MicroStrategy aka Strategy aka MSTR has turned itself into a Bitcoin balance sheet. When you want the strongest base layer of your crypto allocation, this is where you put it.

From a portfolio perspective, Bitcoin should be your bedrock. It has the highest liquidity, the deepest market, and the strongest brand. It is also the least likely to be regulated out of existence. The US government has already blessed it by allowing spot ETFs. The institutional flows are here. The volatility will never go away, but the long-term trajectory is clear. Over the next decade, as fiat currencies inflate, Bitcoin’s fixed supply of 21 million coins becomes more and more significant. If you believe in math, scarcity, and history, you own Bitcoin.

Now move up to Ethereum. Bitcoin may be the base, but Ethereum is the operating system of the new financial world. Ethereum is programmable money. It powers smart contracts, stablecoins, decentralized finance, NFTs, and the next generation of Wall Street rails. Every major bank experimenting with tokenized assets is building on Ethereum or compatible chains. The analogy is simple. Bitcoin is gold. Ethereum is oil. You burn it to power the economy. That is why it has staying power.

Ethereum also gives you something Bitcoin does not. Yield. By staking Ethereum, you earn a return. Through platforms like Coinbase, you can lock up your ETH and collect a 2 to 4 percent yield. That is income. And when you combine that with the potential for 10x price appreciation over a decade, the asset becomes unique. It is both a growth equity and a bond. It pays you to hold while exposing you to massive upside. That is why Ethereum deserves the middle tier of the pyramid. It is not as established as Bitcoin, but it has more utility. It is riskier, but the potential rewards are higher. When you add ETH to your portfolio, you are betting on the future of finance itself. You are betting that settlement, clearing, lending, and trading will move on-chain. That bet looks smarter every year.

Staking is worth emphasizing because it reframes crypto from being purely speculative to being productive. Think of it like owning a rental property that not only appreciates in value but also pays you monthly rent. If you hold ETH, do not let it sit idle. Stake it. That way you capture the two ways it creates wealth: price appreciation and yield.

The easiest way to get exposure to Ethereum today is through the new spot ETFs. The largest by assets are the iShares Ethereum Trust (ETHA) from BlackRock, the Fidelity Ethereum Fund (FETH), and the Grayscale Ethereum Mini Trust (ETH). Each gives direct access to ETH inside a brokerage or retirement account, with fees ranging from about 0.15 to 0.25 percent. For more tactical traders, the Bitwise Ethereum ETF (ETHW) is also gaining traction. Together, these products make it simple to hold Ethereum without wallets or exchanges.

At the top of the pyramid sits Solana. Solana is a layer one blockchain built for speed and scalability. It is cheaper and faster than Ethereum, which makes it attractive for developers and applications that need high throughput. Gaming, micropayments, NFTs, and other consumer applications often prefer Solana because of the user experience. For investors, Solana is speculative. It does not have the same track record as Bitcoin or Ethereum. It has faced outages and competition. But it also has shown resilience and regained momentum after setbacks. If Ethereum is the New York Stock Exchange of crypto, Solana is Nasdaq. Nimble, fast-moving, riskier, but full of innovation.

You do not put your life savings in Solana. You put a small percentage. Enough to participate if it explodes upward, not enough to ruin you if it fails. The asymmetric bet is clear. Solana has the potential to multiply far faster than Bitcoin or Ethereum. If it does, the small allocation pays off in a big way. If it does not, your foundation is still intact. That is why it belongs at the top.

With these three layers, you have a complete crypto allocation. You have the safety of Bitcoin, the utility and yield of Ethereum, and the speculative upside of Solana.

Access is easier than ever. You can buy Bitcoin, Ethereum, and Solana directly on Coinbase or Robinhood. You can put them in a hardware wallet if you want custody. Or you can own ETFs like IBIT, which track Bitcoin directly and can be held in retirement accounts. For equities, you can buy MicroStrategy if you want a levered bet on Bitcoin. The point is, you do not have to be a crypto native to participate. Wall Street has brought the on-ramps to you.

Liquidity is another reason this fits inside the Income Operating System. Unlike real estate or private equity, your crypto holdings in Coinbase are liquid 24 hours a day, 365 days a year. You can sell at midnight on a Sunday if you need cash. That liquidity is powerful. It gives you flexibility. It gives you options. It makes your portfolio more resilient. When the world is unpredictable, liquidity is king.

How much should you allocate? That depends on your risk tolerance, income levels, and other assets. If you are conservative, 5 to 10 percent may be enough. If you are more aggressive, 20 to 25 percent could make sense. The beauty is that even a small allocation can move the needle. If Bitcoin 5x’s and Ethereum 10x’s over the next decade, a modest exposure can change your net worth dramatically. You do not need to go all in. You just need to participate.

It is also important to understand the risks. Crypto is volatile. Prices swing wildly. Regulators are still defining the rules. Hacks and frauds still happen. You cannot treat it like a savings account. But the risk is why the returns are so high. The risk is why you limit your allocation. The risk is also why you diversify within crypto itself, using the pyramid.

We are entering a decade where fiat currencies will continue to erode, where inflation will continue to eat savings, and where technology will continue to reshape finance. In that world, not owning crypto is the risky choice. Every income operator should have exposure. Not because it is trendy. Not because you heard about it on Twitter. But because it is now a fundamental part of a balanced, resilient portfolio.

Crypto is not a side bet. It is not a lottery ticket. It is a core asset class, as real as equities and real estate. The pyramid gives you the discipline to treat it that way. Build your base with Bitcoin. Add your growth with Ethereum. Take your shot with Solana. That is the framework. That is the operating system.

The financial and political chaos is not going away. Your job as an investor is to prepare, to build, to structure. The crypto investing pyramid is one of the cleanest, most powerful structures you can add to your Income Operating System. The people who treat it with that seriousness will not just survive the coming storms. They will come out stronger.